THE NON-PROFIT SECTOR

Trends and Challenges

Compensation levels are reported as challenging for 80% of non-profits. Retention is further impacted by the acceleration of shifts from pandemic induced increased desire for remote work flexibility (75% of NP staff). Work-life flexibility can be most impacted by process automation and collaborative work tool. Apart from remote work preferences, the following long-term trends will impact almost every organization.

Generation Z

The oldest group in Gen Z turned 25 in 2021, and over the next 5 years, Gen Z will become the largest consumer demographic. This group has grown up in the digital world and must be reached and cultivated with digital tools and social media. 66 percent of nonprofits said they favor management platforms or software that assists with tasks like fundraising or social media. Creating an identity with your mission through digital engagement now is key.

Internet-based fund raising

In the same way that Internet-based grassroots fundraising has captured the biggest share of political donations from large check writers, nonprofits are seeing an increasing percentage of donations through web campaigns and a recurring credit card or ACH donations. The easier it is for donors to make payments, and the more targeted and nurturing the campaigns are the better.

Program efficiency

Continuing pressure on organizations to achieve the highest possible program efficiency ratio. Organizations are examined by many donors to determine what percent of their gift will “go to work” on program expenses (vs organization admin – incl. outreach). The surest way to achieve this is to leverage process automation with applications such as Accounting Seed.

Increasing importance of video

Embedding video – which may be best for younger cohorts who may be better looking “underproduced/amateur” than highly professional – is becoming the most effective web tool. Virtual events will become more common, with many opportunities to capture and show mission successes.

Unique Financial Requirements

Non-profits receive two types of funding – restricted and unrestricted. Restricted funding is provided with stipulations on types of grants/expenditures it may be used on, while unrestricted funding may be used to defray the organizations operating expenses (as well as for program outlays).

It is critical for non-profits to be able to track and account for restricted funding in such a way that funds received can be matched with permissible outlays, in addition to being able to track gifts by the campaign, source type, and donor. This requirement fundamentally separates non-profit accounting from the for-profit sector (with exceptions for banks and law firms). Many consulting firms which are technically capable with SalesForce, struggle with this requirement, and the associated reporting and reconciliation capabilities needed.

Ayodia Approach

The SalesForce Non-profit Success Pack, an application used by many of the leading philanthropies, has a feature called the General Accounting Unit (GAU) which is a child on the giving opportunity record. This feature enables a single gift to be assigned to one or more restriction categories set up by the organization. A single gift can be split with each amount assigned a separate restriction.

The purpose of this feature is to facilitate the integration with an accounting system which will then track program and restriction sub-accounts.

The feature has advantages and drawbacks on use:

It requires additional entries and clicks on the Opportunity and adds user tasks for the completion of the donation.

It is a very viable solution to the need to break a single gift into buckets with different restrictions. Each separately restricted portion can be then mapped from the assigned GAU to a general ledger account, or a sub-account created with an accounting tag or variable.

If the client plans to use the Non-Profit Success Pack, Ayodia advises the client on the desirability of using GAUs, as opposed to using giving opportunity record type and fields to automate the selection of GL accounts and variables, to simplify the user experience and increase the level of automation. If the decision is not to use GAU’s then a configuration table is used to display the mapping in one location and enable user edits.

Ayodia implements or creates donor payment solutions for electronic and recurring electronic giving, with cash receipts automatically created and registered to the opportunity for credit card or ACH payments.

Ayodia believes that Accounting Seed and the SalesForce Marketing Cloud provide the best basis for financial automation and social/online digital engagement and spend evaluation today. The combination of these two suites provides a compelling answer to non-profit sector challenges.

Case Study

Girl Scouts of America

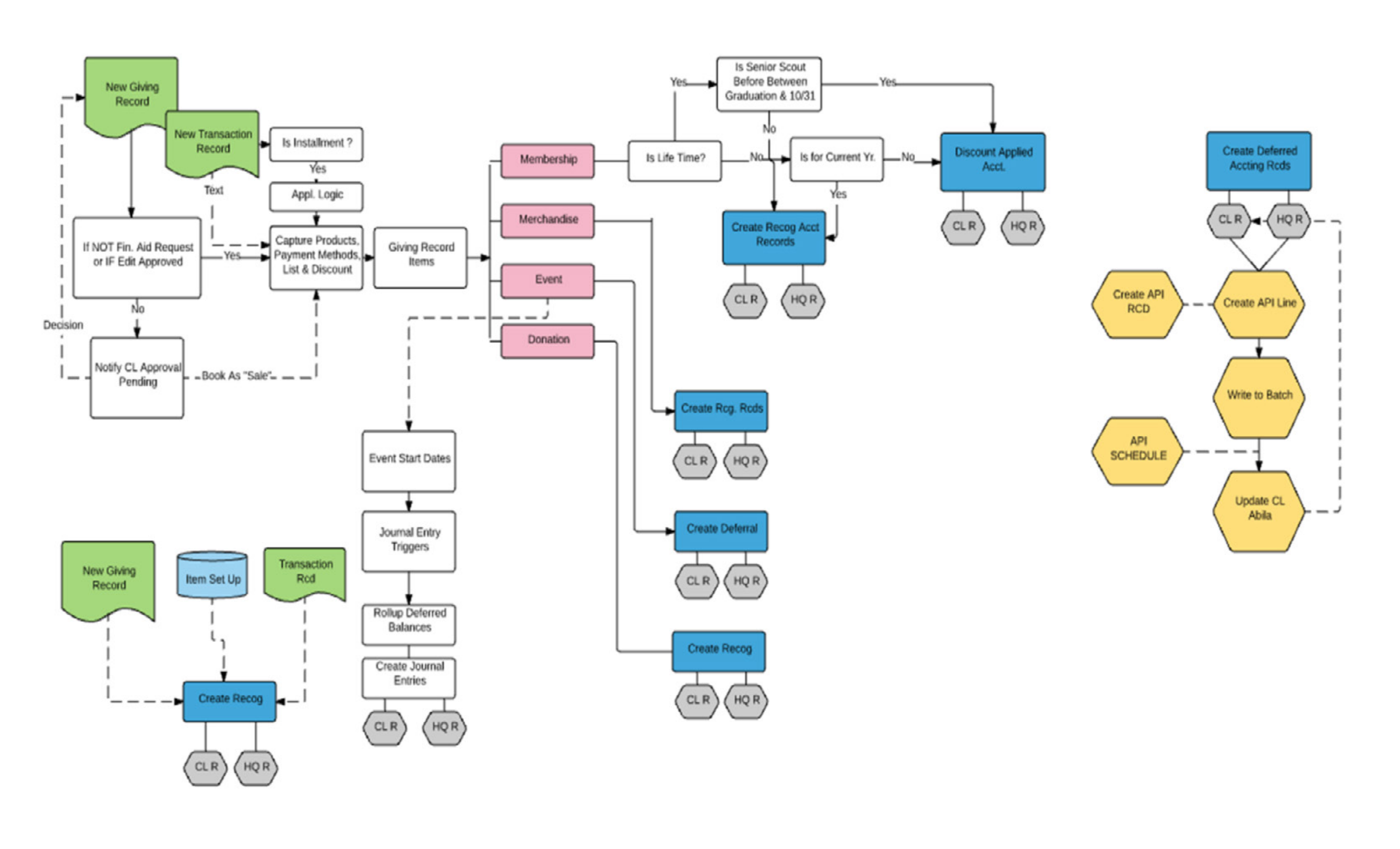

The Girl Scouts of America is a 2.5-million-member non-profit with over 100 local Councils. Each fall the membership base enrolls on the GS site with a council and makes a membership payment. The Girl Scouts needed to match the memberships to councils and create accounting cash receipts for each membership. All member data needed to be provided to the Councils, along with distributions of portions of the membership fee. In addition, members are able to select and pay for events (such as camps) specific to the council. Since the national organization was encouraging councils to go on to the SalesForce/Accounting Seed platform, deferral accounting (with income recognition on event start dates) was needed. High level requirements from the discovery process were

The need for automated entries from the e-commerce site (and SalesForce/Accounting Seed sub-ledger to the GSUSA legacy accounting system (Abila)

Enable a daily Council account sweep via JPMorgan Chase of member dues.

Inject A/R and cash receipts into GSUSA’s legacy accounting system via the Abila™ API, as well as the separate GL’s of the Councils.

Numerous accounting special cases, including conditional income deferrals with automated time-based recognition, a-symmetry between Council and GSUSA accounting requirements. Intermittent support capability of 3rd party accounting platform (Abila).

Architecture to avoid triggering service quality impacts from potential high SalesForce record transactions.

A simplified process map was used to understand the required workflows

Ayodia Role in Project

- System Architecture

- Process consultation

- Apex and VF Customizations in

- Accounting Seed and SalesForce

- Creation of bank ACH sweep files

- Abila integration

Results

All GS requirements for both the councils and the national organization were successfully met, with a dramatic decrease in staff time needed to repetitive tasks on membership drives and council event management.

TO DISCUSS

YOUR SPECIFIC NEEDS

Call us at (866)-640-8950

7:00 AM to 9:00 PM Eastern Time